DoL WH-382 2009 free printable template

Show details

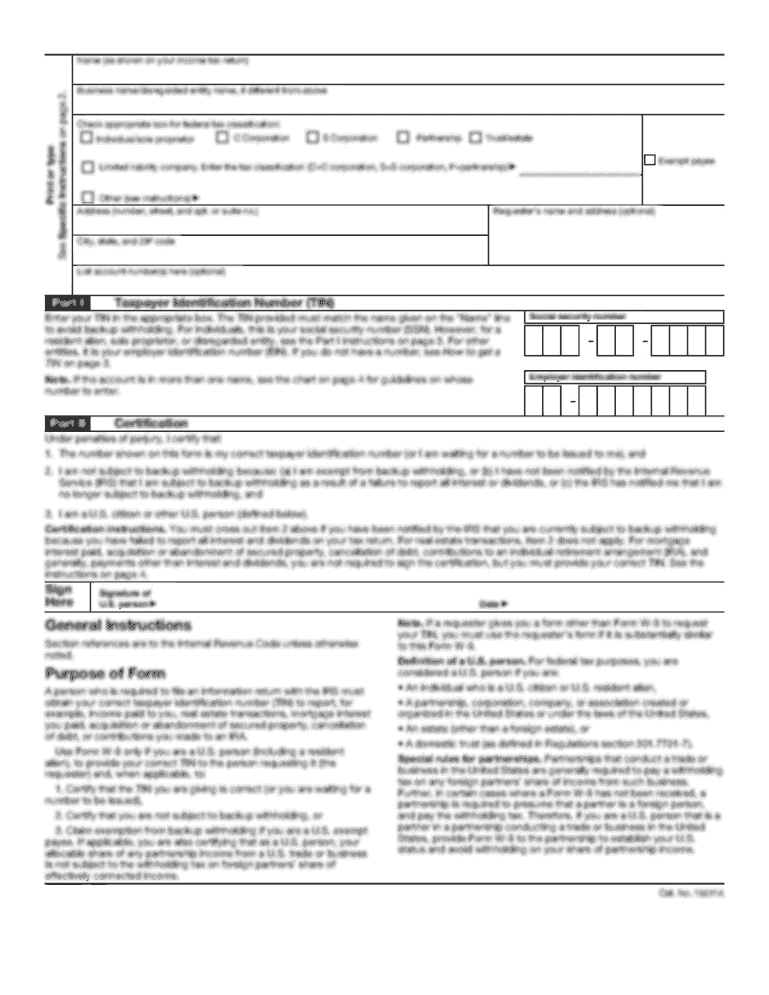

Designation Notice

(Family and Medical Leave Act)U.S. Department of Labor

Wage and Hour Division OMB Control Number: 12350003

Expires: 8/31/2021

Leave covered under the Family and Medical Leave Act

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your 382 form 2009 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 382 form 2009 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 382 form online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit labor wh 382 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

DoL WH-382 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 382 form 2009

How to fill out 382 form?

01

The first step in filling out the 382 form is to obtain the necessary form from the appropriate authority or website.

02

Next, carefully read the instructions provided with the form to understand the requirements and any additional documents or information needed.

03

Fill in the required personal information such as name, address, contact details, and social security number, accurately and completely.

04

Follow the instructions for each section of the form and provide the requested details, such as income information, tax deductions, and credits.

05

Triple-check all the information provided to ensure accuracy and completeness.

06

If needed, attach any supporting documents or evidence such as receipts, statements, or forms required by the authority.

07

Finally, sign and date the form as per the instructions provided.

Who needs 382 form?

01

Individuals who have income from various sources are often required to fill out 382 form to report their earnings accurately for taxation purposes.

02

Self-employed individuals, freelancers, and independent contractors who do not receive a Form W-2 from an employer might need to fill out Form 382 to report their income.

03

Individuals who have received income from interest, dividends, or capital gains may also need to fill out Form 382 to report these earnings.

04

Additionally, individuals who have had tax withheld or made estimated tax payments throughout the year might need to fill out Form 382 to reconcile their tax liability.

05

It is advisable to consult with a tax professional or the relevant tax authority to determine if you need to fill out Form 382 based on your specific income sources and circumstances.

Fill dol wh 382 form : Try Risk Free

People Also Ask about 382 form

How do I get FMLA in Michigan?

How to apply for FMLA in Michigan?

What is the longest you can take FMLA?

How do I get paid for FMLA in Michigan?

What is form 382?

What are the rules around FMLA?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 382 form?

The term "382 form" does not refer to a specific form. It is possible that you may be referring to Form 382, which does not exist. It is recommended to provide more context or specific details to accurately determine the meaning or definition of "382 form".

Who is required to file 382 form?

The 382 form, also known as the "Net Operating Losses and Built-In Gains/losses Calculation" form, is typically required to be filed by corporations or companies undergoing an ownership change.

Specifically, this form is used by acquiring corporations after a merger, consolidation, or other forms of corporate restructuring, to calculate and track any limitations on the use of net operating losses (NOLs) and built-in losses. These limitations are imposed under Section 382 of the Internal Revenue Code.

Therefore, it is the acquiring corporation that is typically required to file the 382 form.

How to fill out 382 form?

To fill out Form 382, you can follow these step-by-step instructions:

1. Obtain a copy of Form 382 from the IRS website or from your tax software program.

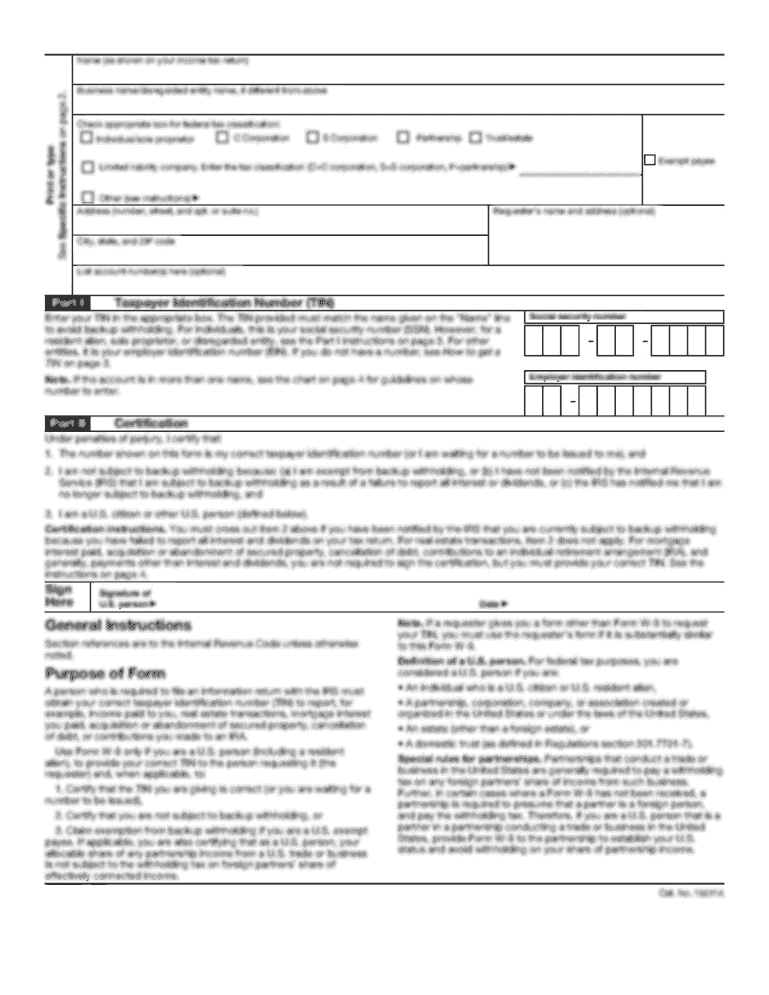

2. Begin by providing the required identification information at the top of the form, including your name, address, and taxpayer identification number (such as your Social Security Number or Employer Identification Number).

3. Indicate whether you are filing the 382 form as a corporation (C or S), partnership, or individual. Check the appropriate box to specify your entity type.

4. Part I: Ownership Change. In this section, you will need to disclose any ownership changes that occurred during the tax year. Include the date of each change, the type of transaction (e.g., sale, purchase, stock issuance), and the percentage or number of shares involved. Follow the instructions provided to ensure all necessary information is included accurately.

5. Part II: Identification of Old Loss Corporation. If the entity undergoing an ownership change was a loss corporation in the past, you need to provide information about the old loss corporation in this section. Include details such as the name, address, taxpayer identification number, and previous tax years of the old loss corporation.

6. Part III: Identification of New Loss Corporation. If the entity undergoing an ownership change expects to be a loss corporation in the future, you need to provide information about the new loss corporation in this section. Similar to Part II, provide details about the new loss corporation's name, address, taxpayer identification number, and anticipated future tax years.

7. Part IV: Taxable Year of the Ownership Change. Indicate the beginning and ending dates of the tax year in which the ownership change occurred.

8. Part V: Aggregate Stock Ownership Changes. If there were multiple ownership changes during the tax year that aggregate to more than 50%, complete this section to summarize the overall changes. Provide the aggregate dates, type of transactions, and percentage or number of shares affected.

9. Part VI: Limitations on Losses Available After the Ownership Change. In this section, compute the limitations on the use of net operating losses (NOLs) that may result from the ownership change. Follow the instructions and apply the required calculations to determine the allowed loss amount.

10. Sign and date the form where indicated at the bottom.

11. Retain a copy of the completed Form 382 for your records.

Note: It is recommended to consult a tax professional or refer to the IRS instructions specific to Form 382 for further guidance and clarification on filling out the form accurately.

What is the purpose of 382 form?

Form 382 is used in the United States for reporting the information related to the Federal Gift Tax and Generation-Skipping Transfer Tax. This form is filed by the executor of an estate or the personal representative of an applicable taxing jurisdiction. The purpose of Form 382 is to report transfers subject to these taxes, including gifts made during the year, and generation-skipping transfers. The form helps determine the tax liability and ensure compliance with the gift tax and generation-skipping transfer tax rules.

What information must be reported on 382 form?

The Form 382, commonly referred to as the Report of Organizational Actions Affecting Basis of Securities, is used to report certain corporate actions that affect the cost basis of securities for tax purposes. Below is the information that must typically be reported on this form:

1. Issuer information: The name, address, and employer identification number (EIN) of the issuer of the securities.

2. Taxpayer identification: The name, address, and taxpayer identification number (TIN) of the person (or entity) responsible for filing the form.

3. Communication information: The contact person's name, telephone number, and email address in case the IRS has any questions.

4. Security description: The description of the securities affected by the organizational action, such as stock, debt instrument, or partnership interest.

5. Securities identifiers: The issuer's CUSIP (Committee on Uniform Security Identification Procedures) number and ticker symbol, if applicable.

6. Date of action: The date the organizational action occurred, such as the date of a stock split, merger, acquisition, spinoff, or other similar events.

7. Details of the action: A description or explanation of the organizational action, including any relevant details affecting the basis of the securities.

8. Tax year of the action: The tax year in which the organizational action occurred.

9. Calculation of basis adjustments: Specific calculations and adjustments of the basis for each affected security, as required by the tax laws and regulations.

10. Supporting statements: Any supporting statements or additional documents necessary to substantiate the basis adjustments reported on the form.

It is important to note that the requirements and specific details for reporting on Form 382 may vary depending on the nature of the organizational action and the relevant tax laws and regulations applicable in each case. Consulting with a tax professional or referring to the IRS instructions for Form 382 is recommended for accurate and up-to-date information.

What is the penalty for the late filing of 382 form?

The penalty for late filing of Form 382 depends on the specific circumstances and the applicable tax regulations in your jurisdiction. It is advisable to consult with a tax professional or refer to the tax authority's guidelines for accurate and up-to-date information regarding penalties for late filing of Form 382.

Where do I find 382 form?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific labor wh 382 form and other forms. Find the template you need and change it using powerful tools.

How do I execute wh 382 form get online?

pdfFiller makes it easy to finish and sign wh 382 fillable online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I edit fmcsa printable form 49 cfr 382 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign designation notice form. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your 382 form 2009 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wh 382 Form Get is not the form you're looking for?Search for another form here.

Keywords relevant to wh382 form

Related to dol designation notice

If you believe that this page should be taken down, please follow our DMCA take down process

here

.